In late December, Congress passed the Consolidated Appropriations Act, which in addition to providing COVID-19 relief provisions also included many tax provisions and extenders. The Act contained many COVID-related tax provisions, as well as a slew of extenders ranging from one year to permanent. This article will focus on the miscellaneous tax and disaster relief provisions, which are more applicable to most taxpayers.

Miscellaneous Provisions

Charitable Contributions – For tax years 2020-2022, non-itemizers can deduct $300 in charitable contributions ($600 for married couples filing jointly).

Full Business Meals Deduction – Typically, business meals are only 50 percent deductible; however, the new tax law provides for a 100 percent deduction for restaurant meal expenses incurred in 2021 and 2022.

Low-Income Housing Tax Credit – Starting in 2021, a 4 percent rate floor is established for calculating credits related to the acquisition of and bond-financed low-income housing developments.

Minimum Interest Rate for Certain Life Insurance Contracts – The bill ties the rates going forward for section 7702 fixed interest rates for life insurance contracts to benchmark interest rates that are periodically updated.

Minimum Age for Distributions – Certain qualified pensions can make distributions to workers who are 59½ or older and still working, with a special allowance for some construction and building trade workers, where the age is lowered to 55.

Modified Charitable Contribution Limits – An extension for one year through 2021 is given for CARES Act increased limits on deductible charitable contributions for corporations and taxpayers who itemize.

Disaster Relief

Disaster tax relief provisions are available for individuals and businesses in presidentially declared disaster areas on or after Jan. 1, 2020, up through 60 days after enactment.

Use of Retirement Funds – Residents of qualified disaster areas can take up to $100k in qualified distributions from retirement plans or IRAs, penalty-free. Taxpayers have up to three years to pay the distributions back without penalty.

Disaster Zone Employee Retention Credit – A tax credit of up to 40 percent of wages (capped at $6,000 per employee) is available to employers who are actively engaged in a trade or business in a qualified disaster zone.

Disaster Relief Contributions – Corporations are allowed qualified disaster relief contributions of up to 100 percent of their taxable income for 2020.

Tax Extenders

Aside from the miscellaneous and disaster relief provisions, the act extended numerous existing tax laws anywhere from one to five years or even permanently. Below is a list of the extended provisions. Due to the number of extender provisions, only a table is provided below.

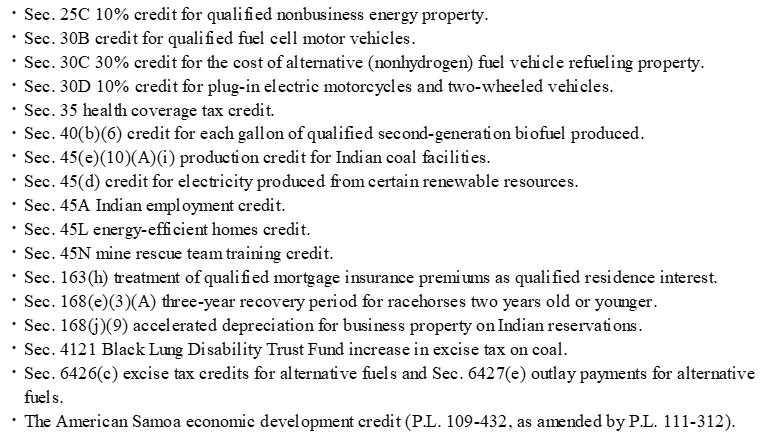

One-Year Extensions

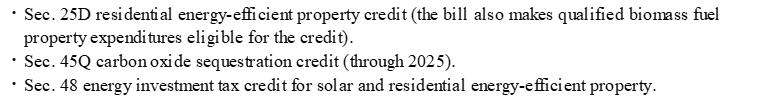

Two-Year Extensions

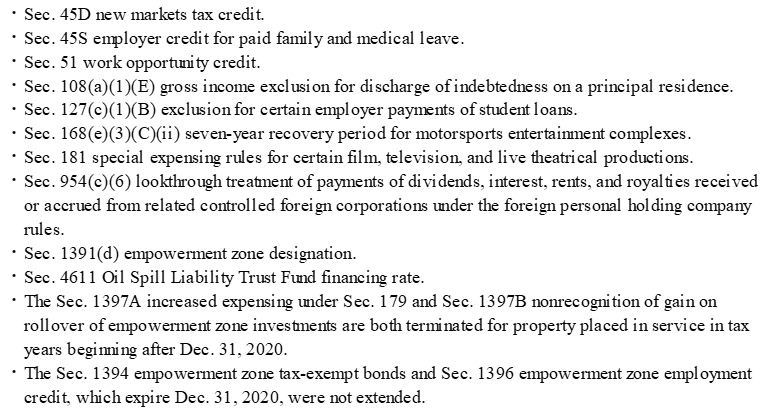

Five-Year Extensions

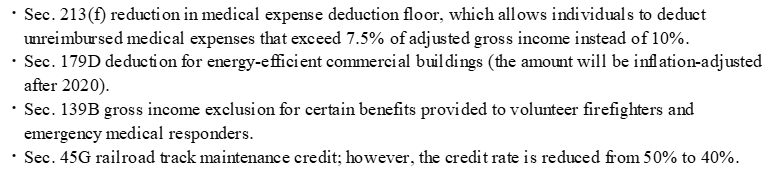

Permanent Extensions

Conclusion

The Consolidated Appropriations Act passed in December 2020 not only extended many existing tax laws and instituted COVID-19 relief, but it also changes many typical tax laws (at least temporarily). Taxpayers should pay attention to these year-end tax law changes as they can significantly impact their tax situations.